History

Aallon Group is Finnish accounting firm that was founded on 2019, following the merger from six locally significant companies, the older subsidiary is Tampereen Kirjanpitotoimisto Oy ( Aalto Tampere) which was founder on 1957 . As the consolidation in the accounting industry developed, these entrepreneurs realized that they had limited options, the typical mom & pop shops in Finland are being acquired by Venture Capitalist, and the rest, by larger competitors. They took the decision to merge in 2018, the merger happened in March 2019, and Aallon was listed on the First North Growth Market on April 2019.

Business Model.

Jumping into the business model, the company is a fairly common accounting firm, with the peculiarity of having 97 % of their revenue derived from invoicing. The other 3 % is divided among different accounting tasks. Focusing on the 97 % invoicing which drives the business, there is of course a cyclical component attached to it, although the business is not concentrated in any particular industry. The economy in Finland has been having a hard couple of years, and Aallon’s organic growth has taken a hit given that many clients ( ex. Builders, Engineering, Entertainment, etc.) are invoicing less in both volume and quantity providing with this less transaction revenue to Aallon.

On the other side of the equation, Aallon has been building their own customer portal which went live on February 2022. The portal provides a variety of financial tools to the customers and it is especially focused on SME needs, it allows businesses to process invoices, payroll, search financial data, etc. I want to highlight that one of the key points here is that Aallon is still using background accounting software, this provides two important advantages in my opinion. The first one, as they purchase new businesses, they are able to integrate them easily, since their customer portal is design to support systems like Fennoa, Netvisor & Procountor, which are the most popular accounting software companies in Finland. The second one, the expenses associated to the customer portal are limited, as an example, a company like Talenom has dragged their returns on capital building a full size software and shifting to become a technology company, this might be a success or not, but it certainly entails a different type of risk that I personally prefer not to be exposed to.

Acquisitions

Acquisitions are a really important pillar for the group’s strategy, since IPO the intention has always been to grow revenue 15-20% , and 70% to 80% of this growth must be provided by acquisitions. To date, Aallon Group has acquired 26 businesses, they acquire around 5 businesses every year, and seem to have a solid and straightforward integration process that allows them to keep buying the small, one or two offices shops without inquiring in margin decreases. The acquired revenue has ranged from 0.5M to 2.5M per company, and the multiple paid is always close to 5x EV/EBITDA. For all companies that dedicate a large part of their strategy to acquisition there are always two key risks, valuation & integration. So far the group has been extremely disciplined on valuation and the integration is made easier in a large extend due to the flexibility that the acquired company has, to keep using their current accounting software. With respect to the “ law of large numbers” the company is small enough that 1.7 M in acquired sales still represents 5 % of 2024 turnover, therefore I consider it to have years of growth with no size concerns. A quick look to the accounting M&A market in Finland, tells us that there are still over 900 accounting offices with more than one employee, out of these, 300 count with 5 employees or more, this gives us a large runway of multiple years where the company will count with an important pool to choose from.

Capital Allocation

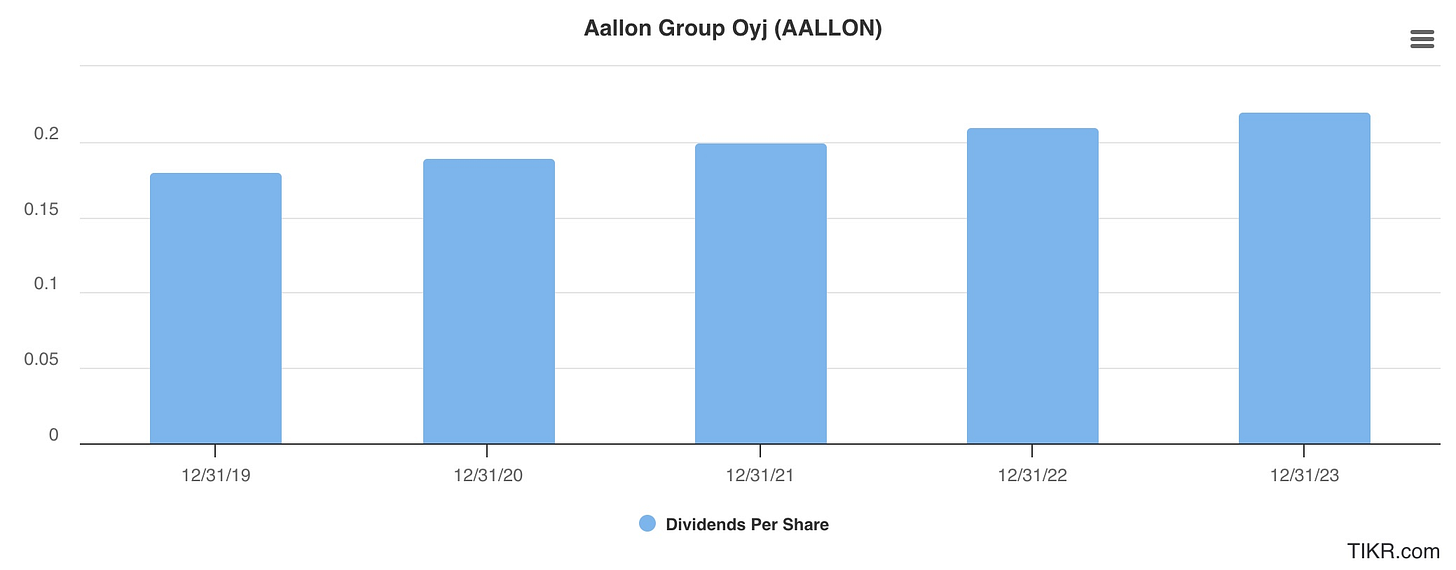

Since IPO Aallon Group has stated their intention to pay 50 % of their earnings per share as dividends. The dividend started at 0.18 cents per share on 2019, and it has grown 1 cent per year, last year distribution was 0.22 cents per share. Given that they are able to pay 5x EBITDA for most of their acquisitions, I would personally like them to allocate the majority of their cash flow there, however, the believe in many of these finance related companies is that a dividend reflects strength, current yield is around 2.7%.

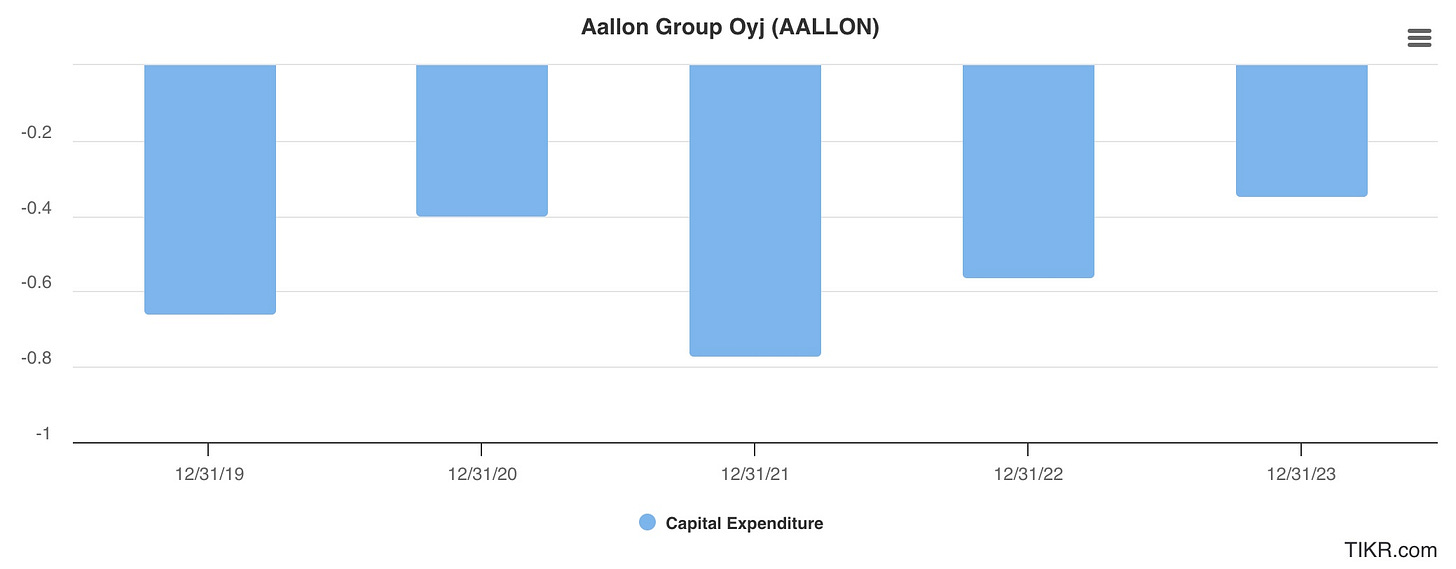

The Capex, as in most asset light businesses, is a small part of cash from operations, it has been decreasing from $660,000 to $350,000 which is good to see, the cash flow conversion is over 80 % of EBITDA, and considerable above the full EBIT and net income.

Share repurchase could be an option given the multiple the company is currently trading at however, there are only 3.9 M of shares, and insiders own over 50 %, which makes the repurchase almost impossible due to lack of liquidity.

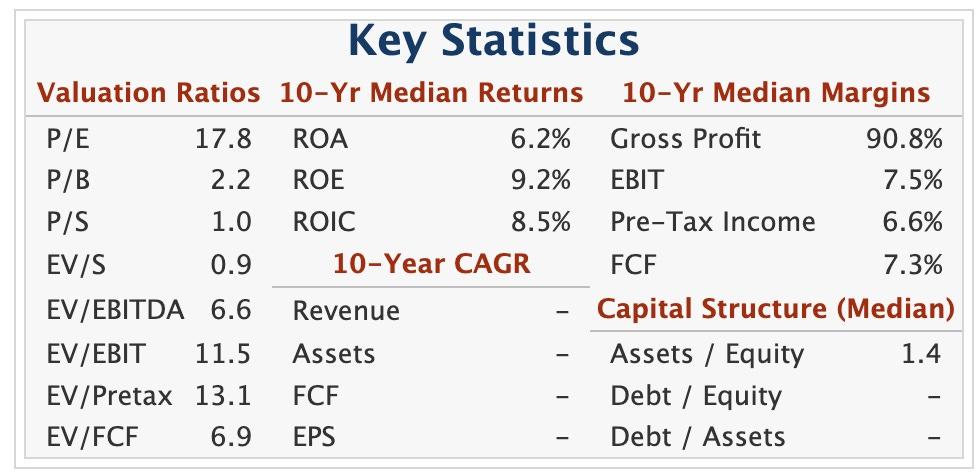

Valuation

The company currently trades at 31M M/C and 32M EV, there is virtually not net debt, and cash if we remove the leases (2 M) which are counted as debt on IFRS 16.

Assuming a modest organic growth, including acquisitions made year to date, Aallon Group should generate 5-5.5M in EBITDA, and 3.5-4M in Free Cash Flow. This places the shares at 6x EBITDA and between 8x9 FCF multiple.

The above are LTM numbers.

I consider this to be a compelling valuation for a highly defensive business, with a ROIC approaching double digits and a light asset business model.

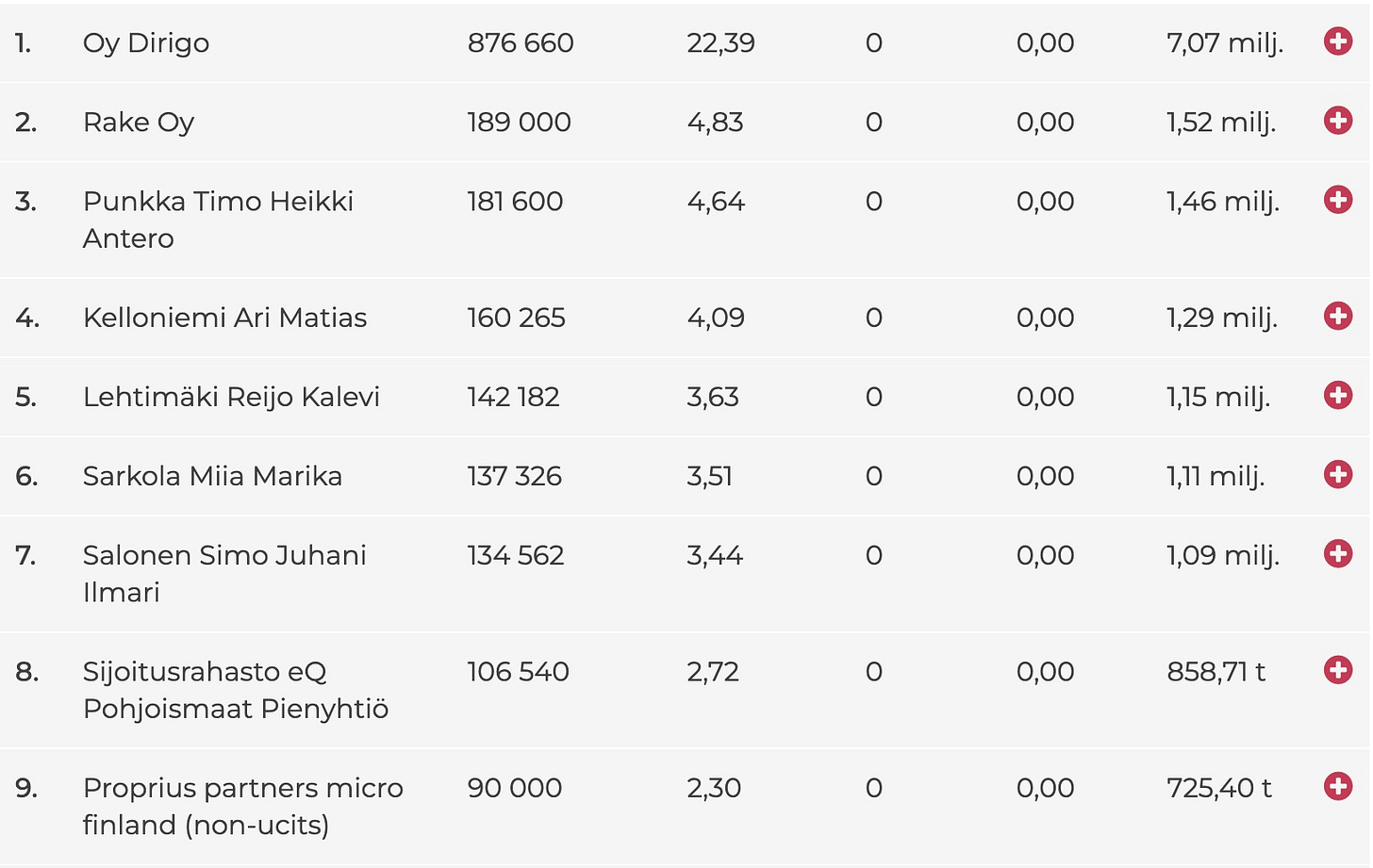

Insiders.

The Board and Insiders own over 30% of the company, most of them through their personal holding companies, this guarantees an important alignment of interest. The Chairman of the Board Mr. Tapani Aalto owns over 22% of the company in its holding Dirigo Oy and 1 % under his name. The CEO Ari Kelloniemi owns over 4% of the company , and the Group Sales Director Mia Sarkola owns over 3 % of the company.

As a good example of the trust the management team and the board has on the business, they have been buying shares over the past couple of years, at prices well above where the business is trading at. The CEO Ari Kelloniemi started with the company on 2019 after the group was formed, and has been making open market purchases every year in order to build his current 4 % ownership. Purchases highly overcome sales, which is something you usually want to see in an insider group.

Why The Opportunity Exists.

I always try to ask this question before analyzing a company further. In this case I believe it is fairly straight forward.

Lack of Liquidity, this is a classic, but with a company trading from 1,500 to 3,000 shares a day with an $8 share price this implies $12,000 to $24,000 exchanging hands per day. Almost impossible to touch for most fund managers.

The company only reports in Finnish, and although Google Translate and other tools might work wonders, a lot of investors prefer to stick to English reporting companies.

The company is a microcap in Europe, in a country that has a border with Russia, again these things are not really important from my point of view, but reading the views of other prior investors in Finland, many of them decided to sell their positions in 2022, if Russia were to attack Finland, I believe we would have far worse issues due to their inclusion in NATO.

The economy in Finland has been fairly slow, as it was expected due to different macro aspects that I won’t detail here, I am not sure when it will improve, but I am positive that it will and Aallon should be a beneficiary of it.

The most common competitor for Aallon is Talenom, which is also an Accounting firm, more skewed towards technology, which I have discussed here before. They have not been really successful with their software investments so far, and there can be the perception that Aallon is doing the same, when they are not.

Conclusion.

This is a solid company, with organic growth between 3-6 % and the intention of acquiring businesses at 5x EBITDA/ 8x FCF to reach 15%-20% annual growth. This has been reached so far with a 16% CAGR from 2019-2024. Insiders own 30% and keep buying, the industry has positive trends and should grow 4% a year for the next 5 years. I consider the business to be fairly valued at around 10x-12x EBITDA and 14-16x FCF, this implies a 100% upside with current numbers. I am not sure if it will or when it will reach this valuation.

Disclosure : This valuation perspective is only my opinion, there is not certainty of it happening, and more importantly, this is not financial advice.

Additional Information

It is important to note that neither in valuation, nor in the conclusion I assumed or used the potential margin expansion that Aallon Group could suffer, if one looks at competitors, a 20% future EBITDA Margin and 17% Free Cash Flow are entirely attainable should that be management’s desire. I am not sure when the R&D expense on the software will be reduce considerably, therefore I decided to ignore this fact completely.

Hello great writeup, will you be putting and update on this company?

How has the market evolved since your writeup?

Good write up thank you. I have that language barrier but indeed translation tools help bridge it.

I thought I read somewhere that they might try build their own software? Is that right?

Separately, they software they currently use, is it provided by another accounting firm or by a pure software company?